Guest blog by Cindy Xin, Zeeshan Ali, Aleksandar Jakovljević, Kelly Jian

The 6-week adventure of how four people who have never been to Zambia fell in love with the country and its challenges in attracting investment.

January 2024. In our first week of the PDIA course, Salimah Samji (the Instructor) listed 8 possible topics that teams would eventually tackle. Of all the big challenges, one stood out as particularly intractable: how do you attract investment into Zambia, a country known as the first COVID-era country to default on its sovereign debt?

The journey we embarked on was long and winding. We were given the initial problem–how can the Government of Zambia better attract private investment? –and wanted to expand how we understood it to see if we could be missing anything. This led us to our first key learning about PDIA:

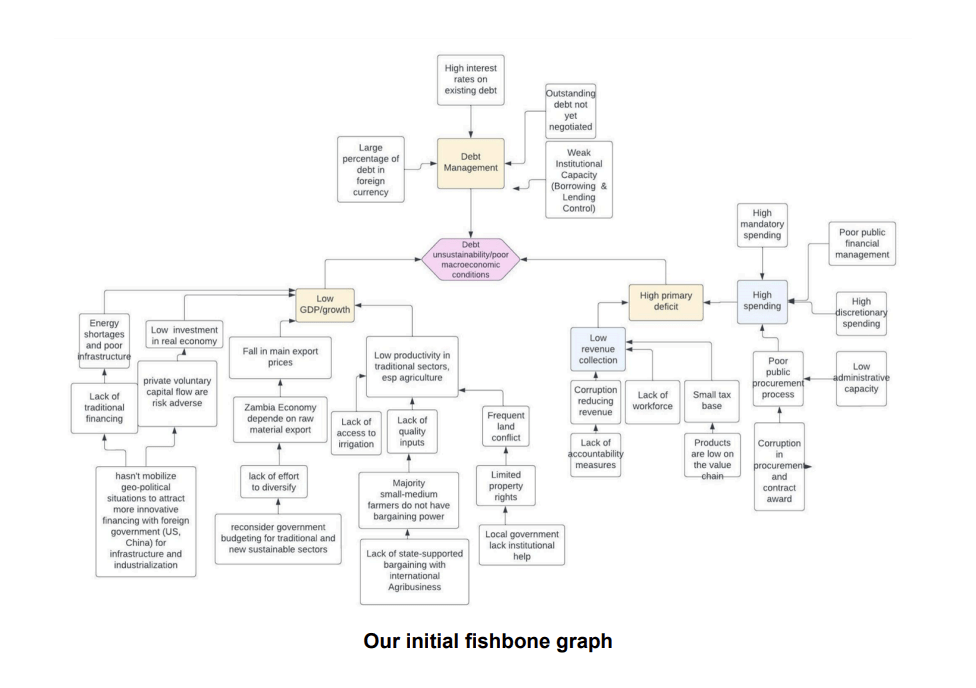

It’s ambiguous: For the first two weeks, this meant examining all the pieces that put Zambia in its precarious borrowing state. We were looking at so many big-picture questions related to Zambia’s growth, interest rates and risk, and level of debt. With so many areas to think about, it became almost impossible to narrow the problem down to anything concrete.

We picked the most obvious challenge–debt crisis– on our first try. However, the more we thought about the problem, the bigger and more intractable it appeared to get. Even as two weeks became three and then four, we were never sure which direction to go next. This led us to the next key learning.

Problem is constructed: With some useful insights from Professor Matt Andrews, we decided to pick a smaller, more tractable challenge within the vast and nebulous space that is Zambia’s macroeconomic health and go with it. As the main concern our authorizer has, which is about how to industrialize the country, we choose a bone of a bone on our original fishbone graph: how to attract investment into Zambia.

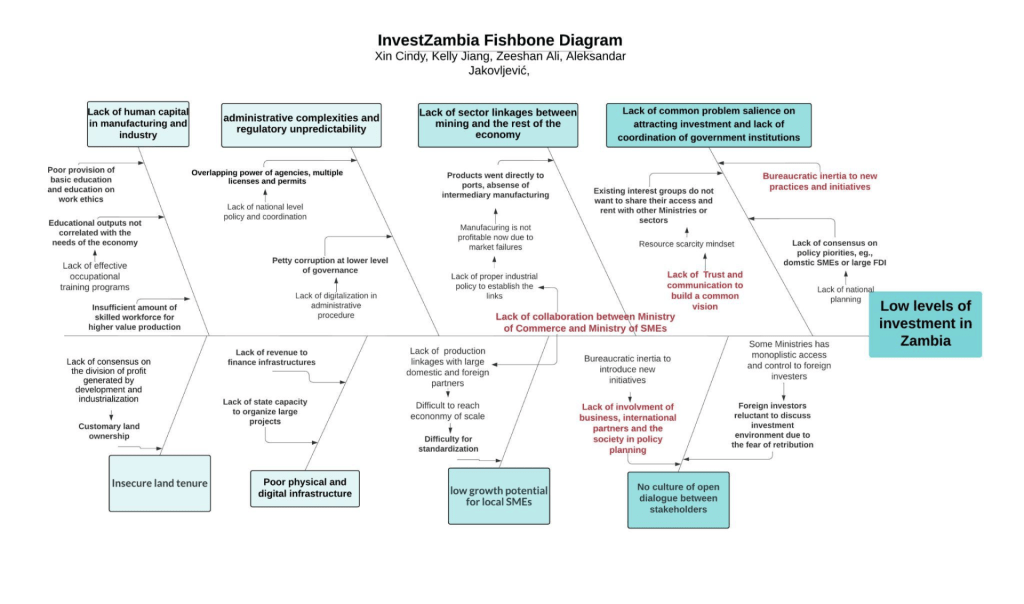

When we describe a problem as “constructed,” we’re not suggesting that it lacks objectivity. Rather, we emphasize the significance of its scope and presentation: the way it is articulated is crucial for enabling us and our authorizer to secure the necessary authorization to act and rally other stakeholders. For instance, by casting the issue as “attracting investment,” our authorizer within the Ministry of Foreign Affairs is afforded a clear and legitimate basis to interact with and involve other stakeholders. It is also better than an “unsustainable debt crisis”. We found that other ministries were reluctant to talk to us if they thought we wanted to discuss the debt, probably because of the ambiguity, legacy, fear, and lack of capacity involved in governments’ handling of such serious and technical issues. In comparison, “attracting investment” is a much more positive and approachable topic. In sum, problem construction is part of our external engagement strategy.

We weren’t sure if this was the right direction (and will never be sure), but we knew it would at least take us one step forward to trying to identify where there are challenges and where we can begin doing the AAA analysis (authority, acceptance, ability) and finding potential entry points.

Meta Thinking

After redefining the problem, we conducted interviews with the Ministry of SMEs and alumni knowledgeable about Zambia’s political economy. However, we faced challenges in engaging critical stakeholders, such as the Ministries of Finance and Commerce, who have not been willing to speak with us. As our authorizer also finds it unexpected, we recognize a broader, systemic issue reflected in the obstacles we encounter. Further efforts to connect with the private sector and our authorizer revealed a systemic lack of common problem salience and a cooperative mindset. Additionally, as the private sector is afraid to talk to us, we observed an absence of a culture of open dialogue and complex interest group dynamics within Zambia’s business environment.

Entry Points to Attract Investment

How to leverage the authority and capability we have to solve complex coordination problems like this? The team identified two possible entry points. The first entry point is to leverage the presence of the Zambian embassy and missions abroad to engage with potential foreign investors, and use these concrete investment cases to engage powerful ministries for small-step conversations and changes. The second entry point is to explore the positive deviance of large investment and PPPs within Zambia in collaboration with the Ministry of Commerce in partnership with development organizations.

Key Learnings from PDIA Exercise

Some of the key learnings include why so-called best practice is not always the way to solve problems, and why taking a problem-driven approach is better than a solution-driven approach. It is crucial to identify problems, conduct brainstorming, generate ideas, put ideas into action through the entry point analysis, observe the outcome, learn, iterate, and adapt. This iterative feed-in loop is a practical framework to solve complex problems. We also learned that entry points can often be a simple yet useful way of initiating actions to address complex problems.

Additionally, we learned how teaming works effectively with the two core elements of psychological safety and accountability to work. And that an act of kindness is indeed contagious!

Words of Wisdom to Share with Fellow Practitioners

Addressing challenges in developing economies is often complex and needs a high level of persuasive and exploratory skills. The reluctance on the part of the government officials to speak to our team did not hinder our work. Our strategy was to continuously engage with potential stakeholders – internal and external within and outside Zambia. We also focussed on exploring several reports, research, publications, and news feeds that were readily available on public domains to better understand the situation in Zambia. It is important to remember that challenges often bring opportunities in some form. The team’s resilience and ability to take stock of the situation, re-strategize when needed, and continue to pursue its objectives resulted in positive outcomes and deep appreciation from the authorizer.

A Word of Thanks

Finally, the InvestZambia team would like to express our heartfelt gratitude to the faculty and program staff for providing this outstanding opportunity to learn and work on the Zambian case.

This is a blog series written by students at the Harvard Kennedy School who completed “PDIA in Action: Development Through Facilitated Emergence” (MLD 103) in March 2024. These are their learning journey stories.