Guest blog written by Francisco Castro-y-Ortíz

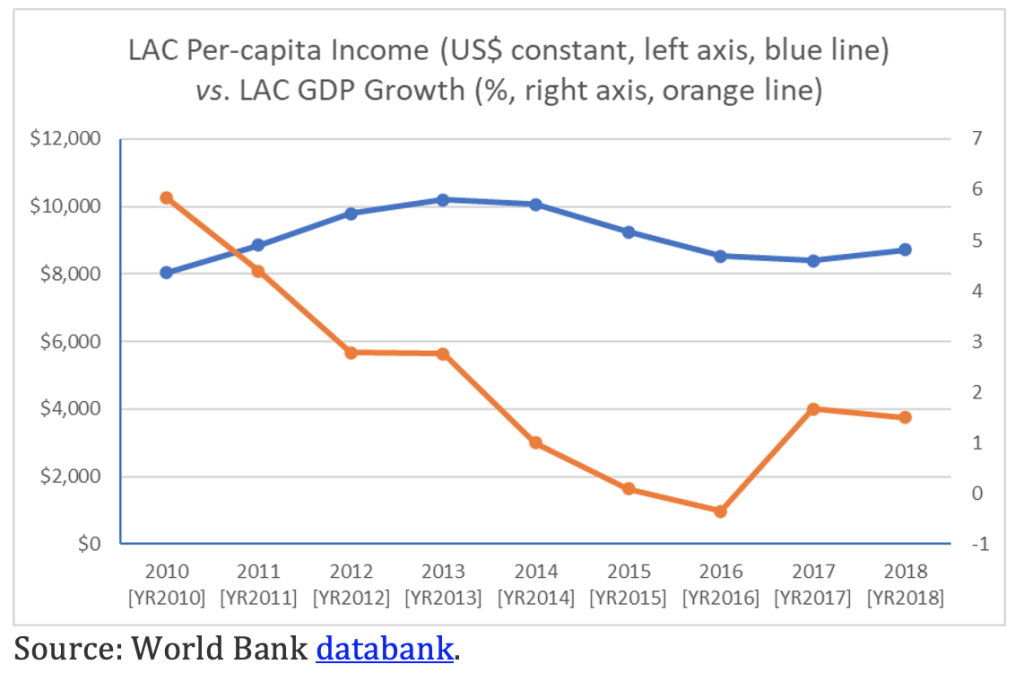

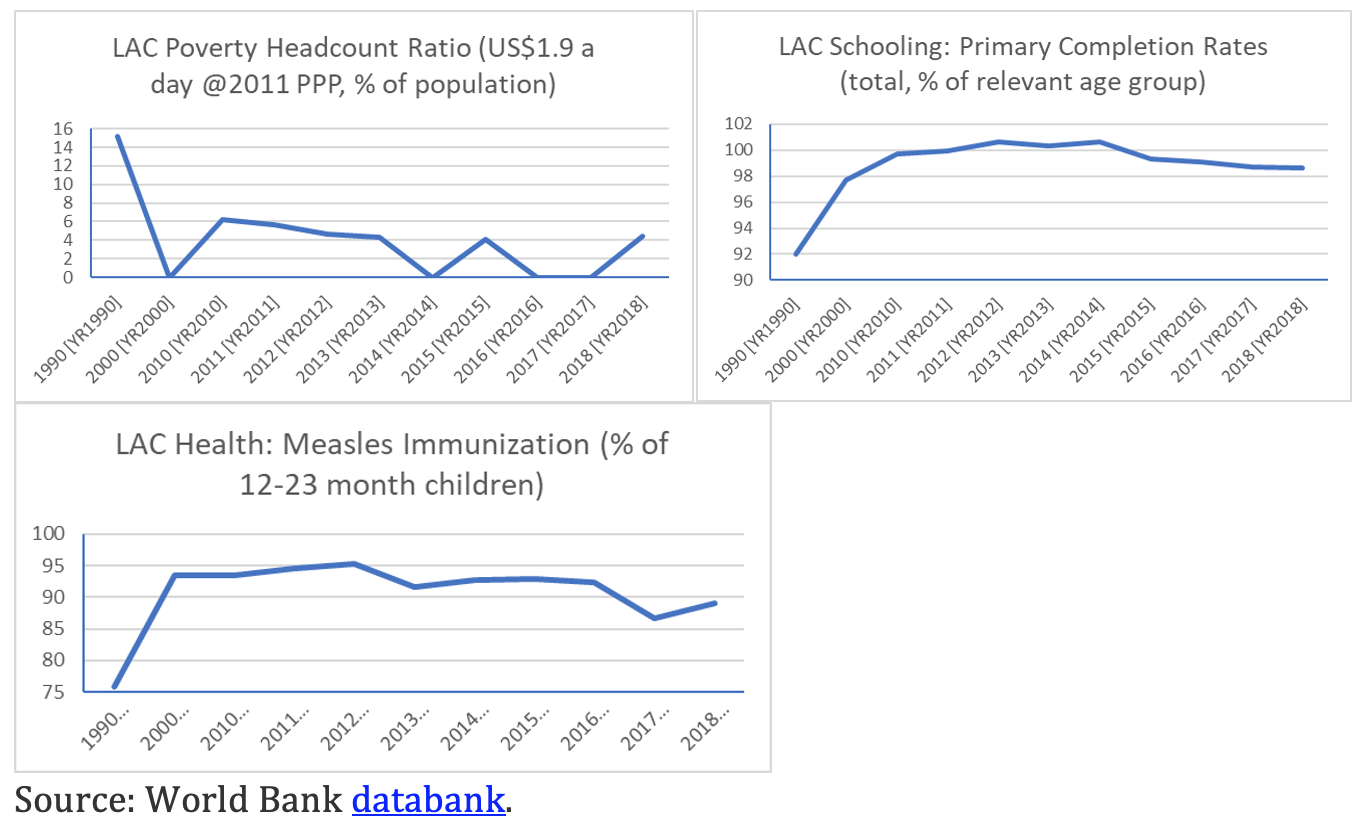

I work for a multilateral development organization—the Inter-American Development Bank—and am a citizen from a Latin-American Middle-Income Country (MIC). Because of this background, the main economic problem I am most concerned about relates to my own country—Mexico—and the Latin-American and Caribbean region (LAC) as a whole. It is about low average growth rates—for more than two decades already. Low growth matters in LAC because it increases the risks of regression, particularly to poverty and other human-development and sustainability metrics. Such an outcome may erase the hard-earned development gains of the last two decades. Furthermore, the problem of low growth is today being amplified significantly because of the COVID-19 pandemic which, if not addressed, may have devastating economic consequences on both growth and sustainable human development.

The problem of low growth and its consequences lies at the heart of multilateral organizations’ Institutional Strategies (IS) working in the LAC region. Some of them will be considering updating them because of high-level managerial changes (tenure periods are expiring), or because of the adverse exogenous shock and economic consequences of the pandemic, or both. As I learned in the 2020 Leading Economic Growth course, following the steps of a Problem Driven Iterative Adaptation (PDIA) approach may decisively help to enhance the formulation and update of the IS of multilateral organizations.

For instance, let us begin with the first steps, constructing and deconstructing the problem to develop a clear problem narrative and “provoke reflection, mobilize attention and promote targeted and context-sensitive engagement”. In the case of LAC, the region has experienced low growth rates since the 1980s consistently. Despite being acknowledged as a “middle income region”, LAC has been stuck in that stage for decades. In addition, if the numerous exogenous and internal shocks that the region has experienced, are factored in, the low growth problem becomes critical because the region does not have enough fiscal space to confront the crises adequately. Consequently, living standards recede, per-capita income decreases, infrastructure and productivity get eroded.

Low growth rates matter because their adverse consequences pose regression risks that affect everyone: middle classes become poorer; a poorer, less educated and less healthy workforce will affect the production function of any company; poor productivity would mean suboptimal private activity and less government revenue, which in turn would mean less resources to be transferred for infrastructure and social safety networks. Low growth rates matter because they can create vicious circles and place countries and entire regions in “middle-income/poverty traps”. Likewise, the low growth problem may look solved if we manage to reverse the average downward trends in poverty and human development indicators that are being observed over this decade, which in turn would mitigate the latent regression risks mentioned.

What are the main causes behind the problem of low growth? Why to they happen? Can we tackle their binding constraints? Next steps in the PDIA approach involve the development of Ishikawa graphs—also known as fishbone diagrams—to address this. Developing such a diagram for the low growth problem in LAC presents challenges, especially because of the heterogeneity of the region—in terms of income, ethnicities, history, politics, among others. The Office of Strategic Planning and Development Effectiveness (SPD) of the IDB therefore performed a 2-year exercise consulting Finance Ministers, academia, private sector, legislative bodies, civil society and other key decision actors across the entire region through focus groups over two years to discern such causes, which lead to the first update to the Institutional Strategy. The Ishikawa diagram to identify binding constraints for the low growth problem in LAC can be formulated based in such rigorous exercise.

According to it, the binding constraints that hinder LAC growth are three: “social exclusion and inequality; low productivity and innovation; and limited economic integration.”[1] The first binding constraint is based on the fact that LAC remains an unequal region despite the undeniable emergence of a middle class. The second one derives from the productivity gaps that have widened significantly over the last 50 years, not in comparison with advanced economies, but also vis-à-vis other emerging regions. The third one is due to LAC’s fragmented integration and concentration of exports on a few volatile commodities and basic manufactures. Public policies that address these challenges must consider that these binding constraints are inter-related and that three common issues cut across them, namely gender equality/diversity, climate change/environmental sustainability, and institutional capacity/rule of law:[2] for instance, exclusion causes poverty and inequality, which is linked to low productivity and manifests itself in informality among others, which is linked to low export potential and thus unsophisticated product space, which in turn explains segmented basic markets and is a reason behind low economic integration in the region.

A key step in the PDIA approach involves detecting entry points to address binding constraints, and ordering engagements based on a progressive approach to tackle problems, given contextual opportunities and constraints. The idea behind this is to create a “space for change” around authority, acceptance, and ability factors. For the low growth problem in LAC, the focus group exercise that the IDB performed among the key decision-making actors upon which the Ishikawa graph above was formulated rendered a small space for change in LAC: increasing growth has large acceptance across all actors, however the authority to pursue action lies mostly in Finance Ministries, which have to untangle the and address the diverse political reaction function of heterogeneous legislative bodies. Furthermore, the ability to implement reforms lies not only in the Finance Ministries, but also in Ministries that have development mandates such as agriculture, housing, environment, health, etc. These implementing Ministries tend to have on average less technical capacity than their Finance counterparts across the region. Such dynamics can be depicted in the Venn diagram below:

As depicted in the Ishikawa graph above, the problem of low growth in LAC is a complex one that can hardly be solved through linear, top-down strategies. In contrast, the PDIA methodology offers a valuable alternative which consists of designing action-learning oriented iterative approaches to address the various and diverse binding constraints. Beyond addressing complexities, these iterative approaches enable to factor-in the local context and to learn from each round before pursuing the next one.

Let us exemplify this iterative “design space” with the LAC Ishikawa graph above. In it, the most accessible areas to start convening internal and external actors into sequenced, iterative discussions of the low growth problem would perhaps be the bones related to social exclusion, particularly the sub-bones of inflation on the one hand, and low tax revenue/deficient budgeting on the other. The external actors relate, on the one hand, to policymakers in Central Banks (CBs, for the inflation problems) and Ministries of Finance (MoFs, for the revenue/budgeting problems). On the other hand, they also relate to legislative bodies, which are responsible to approve any reform proposed. Most CBs and MoFs in the region do have very technical, competent officers (with some exceptions, but they are the minority). Thus, a discussion with them on inflation, revenue and budgeting being critical to address social exclusion problems such as poverty, inequality and the real and monetary consequences of the COVID-19 pandemic would be relatively feasible to convene. Actors on the legislative side would be more challenging to convene, as they have a political, non-homogeneous reaction function, so this group should be convened perhaps in a later iteration. The first buy-in needs to be done at the technical, executive branch, with small-step reforms that show progress in local context, and then use this progress to lobby legislators and engage them in the next iteration.

Internally, the actors to be convened at a Multilateral Development Bank (MDB) would be its economists from the strategic planning and development effectiveness office, which are versed on performing impact evaluations through randomized control trials, to test the impact of each step performed. Likewise, economists from MDB Country Offices (COfs) should also be involved because they are stationed directly on the field and are responsible of the dialogue with the local authorities, including MoFs, CBs, legislators and civil society. In fact, COfs economists are also critical to convene the external people (i.e. policymakers in MoFs and CBs) because they are aware of the economic and political sensitivities of the local contexts in each country.

To be effective, this contextual learning-by doing iterative process needs careful crawling of the “design space”. This means identifying the sub-causal dimensions of each fishbone, gathering the substance needed form new ideas, and pursue selected actions to find ideas in practice domains. In particular, the aim of each iteration would be to discern if an idea is technically correct, while being administratively and politically feasible in a targeted context. To this end, crawling the design space in each iteration would involve identifying existing (or local) practice, contrasting it with external (i.e. “best”) practice, detecting latent practice (i.e. selected local ideas and capabilities being tried which can provide possible contextual solutions in a short period), and developing positive deviance (i.e. ideas and capabilities that already yield positive results but that are not the norm yet).

Let us exemplify and summarize these iterative approach steps with the help of the following table, which addresses the fishbone related to social exclusion of the low growth problem from the LAC Ishikawa graph above:

| sub-causal dimension of social exclusion | substance needed from new ideas | actions to find ideas in the practice domains |

| inflation | new practice: quantitative easingexpand authority: coordination with Ministries of Finance (MoFs) expand acceptance: technical understanding from legislative and civil societyexpand ability: research, staff exchanges | existing: inflation targetslatent: lowering target interest rates+deviance: Central Banks (CBs) going beyond monetary stability mandate to consider stimulating growth actions (e.g. Chile, Mexico)International Best Practice (IBP): quantitative easing, purchases of non-traditional debt instruments (particularly Federal Reserve [Fed], European Central Bank [ECB] and Bank of England (BoE) |

| deficient budgeting | new practice: results-based budgeting, multi-year budgetingexpand authority: diminish excessive political bargaining with legislative/sub-nationalsexpand acceptance: technical understanding from legislative, sub-nationals and civil societyexpand ability: define achievable targets, timelines and demonstrate results, perform regular reviews and audits | existing: traditional annual budgetinglatent: results-based budgeting pilots+deviance: successful policy-based loan interventions in selected LAC countries (e.g. IDB in Perú and Costa Rica)IBP: results-based budgeting, multi-year budgeting, public expenditure reviews, independent audit (particularly European OECD countries) |

| low tax revenue | new practice: progressive taxation though green taxes, flat taxes, Tobin-type taxesexpand authority: diminish excessive political bargaining with legislative/sub-nationalsexpand acceptance: technical understanding from legislative, sub-nationals and civil societyexpand ability: define targets/objectives and demonstrate results | existing: traditional Value-Added Taxes (VAT), excise taxes, income taxation/corporate taxation by population income segment, complex taxation deduction regimeslatent: flat taxation and Tobin-type taxation experiences in selected countries (e.g. Mexico), reporting simplification (e.g. Mexico, Colombia, Brazil, Chile)+deviance: successful policy-based loan interventions in selected LAC countries (e.g. IDB and World Bank [WB] interventions in the above countries)IBP: progressive taxation though green taxes, flat taxes, Tobin-type taxes (particularly European OECD countries) |

Besides designing and pursuing each iteration, the critical part of this process involves first, developing the authority to implement the approach; and second, measuring the results and impact from each iteration to take stock and learn from it for the next one. To tackle complex problems, the leadership behind the authority needed is usually not centered around charisma, but rather around “leaders of teams” that interconnect with and feed upon each other—like an orchestra, where the Director relies on the leaders of each section, which can play things and instruments she cannot—where the diversity of views and skills enriches the solutions. Likewise, the development and adoption of precise, granular, and impactful metrics are essential for iterative learning.

These last steps are the most challenging to pursue in multilateral organizations such as IDB or the World Bank. First, using the orchestra analogy, while multilaterals are structured around a leadership that could mirror the “orchestra” analogy—a Presidency, and Vice-Presidencies of practices/sectors, and countries/regions—they also are “white elephants” where the incentive to change is limited because of external political constraints and internal bureaucratic inertias.

Second, the traditional approach on measuring impact on supporting growth strategies by multilaterals has been, at the aggregate level, through corporate scorecards which incorporate performance indicators at the country, regional and corporate level. While this approach has proven useful for Senior Management to steer the organizations and maintain their relevance in a world where multilateralism is being challenged, they are also showing increasing limitations in terms of addressing the contextual local causes of a more inclusive and sustainable growth among and within countries.

The approach that Senior Management in multilaterals has pursued to take corrective action has been either to increase the indicators in their respective institutions’ scorecards, or to simplify them by grouping into levels of aggregation (e.g. regional, country, and corporate). A better approach that could be proposed would be to filter those indicators by incorporating in them measures that place more weight in the local context and make use of “economic complexity” and “product space” diversification concepts.

For instance, Hausmann’s (et. al.) Atlas of Economic Complexity points out that most countries in the LAC region have a relatively concentrated composition of exports—which should not be surprising given that LAC is known as a commodity-rich region in terms of agriculture and mining resources. Even in the countries with a more diversified and complex product space—such as Mexico, Brazil or Colombia—such spaces are concentrated within specific sub-regions (for instance, Nuevo León or Querétaro in Mexico, where the vehicles and aerospace components manufacturing are concentrated), thus exacerbating country inequalities based more on productivity cleavages than on income cleavages. It follows that if multilateral organizations would include among their indicators a measure on how their interventions contribute to diversity the product space in sub-regions where production is concentrated, the country indicators of their respective scorecards would become more meaningful.

Furthermore, such an approach would help to steer multilaterals towards focusing more on sub-nationals and sub-regions instead than on sovereigns, as they traditionally have done. The challenge here would be that these institutions lend on a sovereign-basis per their respective Charters and business models/mandates. Nevertheless, MoFs would be interested if multilaterals focused more on sub-nationals, as they also look forward to making the benefits of growth to be more widespread shared. From this perspective, both country authorities and multilaterals’ Senior Management share the same goals, and thus lending and the sovereign level should not be at the expense of sub-sovereign challenges and needs—but would actually incorporate and address them.

As a final remark, it should perhaps be mentioned that regional multilateral organizations—like the IDB—may have a crucial advantage over global ones—like the United Nations—in pursuing PDIA-based approaches to update their Institutional Strategies because they enjoy a unique comparative advantage: client proximity. This advantage, in its different dimensions—local presence, language, culture—enables them to act as effective conveners and trusted technical and political advisors. Regional multilaterals have thus a better local knowledge of the “sense of us”[3] in their respective regions and countries, and usually are perceived by their clients as “part of them”—this is the case of the institutions of the inter-American system such as the IDB, or the Pan-American Health Organization (PAHO).

The views expressed are the author’s only and do not reflect the views of the Inter-American Development Bank.

This is a blog series written by the alumni of the Leading Economic Growth Executive Education Program at the Harvard Kennedy School. Participants successfully completed this 10-week online course in July 2020. These are their learning journey stories.

[1] See https://publications.iadb.org/publications/english/document/Update-to-the-Institutional-Strategy-2010-2020.pdf, p. v.

[2] These cross-cutting issues were updated in 2018 to include technology/innovation, resource mobilization, see https://publications.iadb.org/publications/english/document/Second_Update_to_the_Institutional_Strategy_Summary.pdf, p. 9.

[3] In the sense that Hausmann refers to in “Footbal, Brexit and Us”, Project Syndicate, 2016.

To learn more about Leading Economic Growth (LEG) watch the faculty video, and visit the course website.