Guest blog written by Ganga Palakatiya

The Investor Engagement team (I team) consisted of government officials working at the Board of Investment, Sri Lanka, to diversify the economy by engaging new anchor investors and attracting Foreign Direct Investors (FDI) in new sectors. This was part of a PDIA engagement from May 2016 to September 2017.

I team members: L K D Lawrance, Nelson Kumaratunga, Dilip Samarasinghe, Vipula Jayasinge, Ganga Palakatiya, Dhammika Basnayake, Krishnatha Britto, Indunil Perera, Hemadree Naotunna, and Rushda Niyas. This is their story!

Based on the Targeting Team (T team) findings on sector targeting, Solar Panel Manufacturing was identified as a potential sector for investment in Sri Lanka. The “I Team,” consisting of dedicated officers for investment promotion, was assigned to promote Sri Lanka as an attractive destination for this and other priority sectors and attract key “anchor investors.” The timeframe given for this task was period of one year. Solar Panel Manufacturing would be a pioneer sector for Sri Lanka. There were no existing manufacturers in the country except one player who was under construction status. Thus, this was a new technology for the country, unfamiliar to Sri Lanka’s workers, suppliers and government bodies. This formed a challenge for the I Team, but with trainings from CID, the team crafted a four-step strategic approach (Figure 1), combining existing BOI investment promotion methods with a more proactive targeting of key sectors, countries and companies.

Figure 1: Strategic Approach of I Team in Investor Engagement Targeting Sectors for FDI Attraction & Export Promotion

- Identification of sectors: The I Team began their consideration of sectors to be promoted based on their understanding and experience; this was coupled with the technical sector targeting mechanism of the T Team. As a result, “Solar Panel Manufacturing” was selected as one of five subsectors to be promoted for investment.

- Understanding the sector: The I Team strongly believed that, prior to approaching investors, the team should understand the sector very well. The team started with desk research to gather information on the global and local scenarios of the solar panel manufacturing sector. Subsequently, they arranged meetings with sector experts, professionals, university academics, relevant ministries, and others. In addition, the team visited a small-scale solar panel assembling plant, gaining an initial understanding of the manufacturing process. All these activities made the team knowledgeable in the field of solar panel manufacturing. Soon, they were confident enough to engage with investors, and could begin to identify target companies to be attracted.

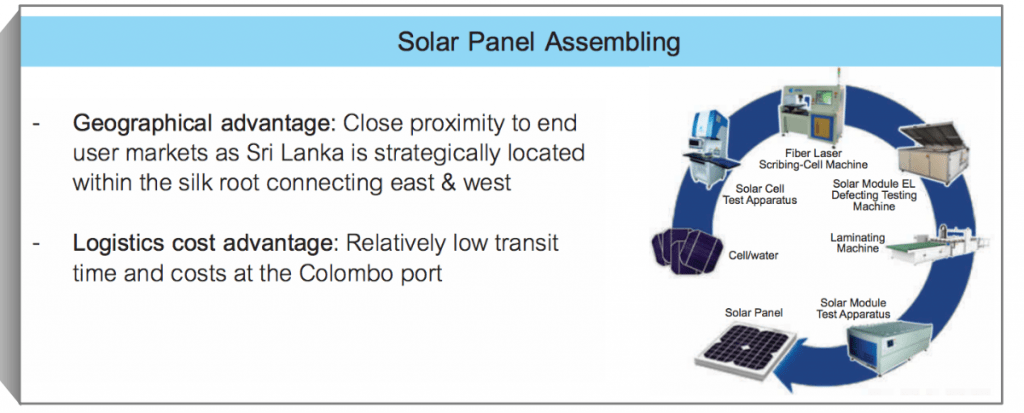

- Promotional Materials: With the understanding of the sector, the team prepared a “pitch book” which could be used as a promotional material at the time of engaging with investors (Figure 2). This pitch book consisted of sector-specific positive factors given in an attractive and summarized manner, which could build a positive first impression of Sri Lanka as a preferred destination for investment. The next step taken was to prepare a “Market Study Report” with detailed information on the Solar Panel Manufacturing sector, which could be distributed among the potential investors.

Figure 2: Excerpt from I Team Pitch Book for Solar Panel sector investment

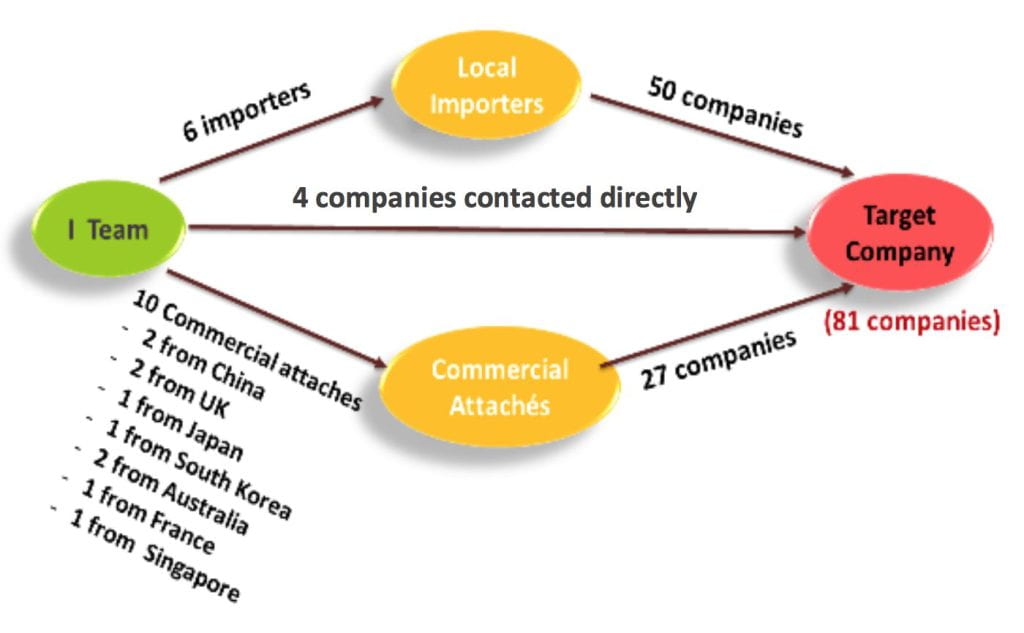

- Building Networks and Engaging with Investors: The final step of the I Team was building a network for direct and indirect engagement with investors. Several contact nodes were identified to engage with target investors such as commercial attaches, business councils, importers, associations, chambers, international gatherings, and others (Figure 3).

Figure 3: Building networks to engage with potential anchor investors

One company, a top Chinese solar manufacturer, was among the top of the target companies of the I Team for the Solar Panel Manufacturing sector. The company had done its initial feasibility studies and visited Sri Lanka to investigate the potential for establishing a solar panel assembling plant there. Its executives met with the top management of BOI along with the I Team members. The I Team received the opportunity to deliver knowledge gathered through their four-step strategic approach and convince them to submit a solid proposal for investment in Sri Lanka. The team arranged a site visit to Mirigama Export Processing Zone (MEPZ), and the company selected MEPZ as their preferred location for the investment project.

The investment proposal consisted of the details of the planned project along with requested policy changes. The I Team immediately acted on these requests and submitted a policy paper for Cabinet Committee on Economic Management (CCEM), chaired by the Honourable Prime Minister. The CCEM granted approval for all the recommendations made, and the investors are now in the process of initiating the investment project in Sri Lanka.

In addition to this investor, there are other solar companies in the queue, from expressions of interest to pre-application. Most importantly, there now exist officers at the BOI with expertise in proactive targeting and engagement of top solar investors (and in other key sectors).

Ganga Palakatiya was a member of the I-team and participated in the PDIA Sri Lanka project from September 2016 to September 2017.

Read the full report here – https://srilanka.growthlab.cid.harvard.edu/files/sri-lanka/files/sri_lanka_report_on_sector_targeting_exercise.pdf

For a full account of the I-Team journey, click here (insert link) https://bsc.cid.harvard.edu/publications/learning-engage-new-investors-economic-diversification-pdia-action-sri-lanka

Read more about the PDIA Sri Lanka project here: https://bsc.cid.harvard.edu/projects/economic-transformation-sri-lanka